What you need to know about the new portable long service leave for cleaning, security and community services workers in Victoria

On 4 September 2018, the Victorian Government passed the Long Service Benefits Portability Bill 2018. The Long Service Benefits Portability Act 2018 (Vic) (LSBP Act) will come into effect on 1 July 2019, unless proclaimed earlier by the Government.

Why has the legislation been introduced?

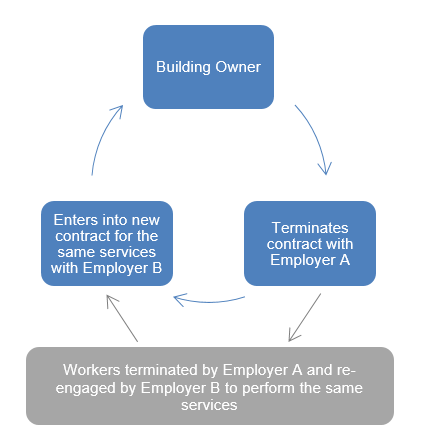

The LSBP Act has been introduced to enable Victorian workers in the cleaning, security and community services industries to retain their entitlement to long service leave when their employer changes.

Workers in these industries have historically speaking, rarely qualified for long service leave due to the contract and project nature of the industries they work in. For example, when a building owner terminates a service contract with one entity and then engages a new entity to undertake the services, with the same employees, there may be no ‘transfer of business’ between the two employing entities/service providers. The employees may become engaged by the new service provider and simply lose their continuity of service under the previous employer/service provider. The LSBP Act is designed to prevent this from occurring.

Who is covered by the LSPB Act?

Importantly, the LSBP Act will apply to employees or contract workers in the following industries in Victoria:

- Community Services Sector;

- Contract Cleaning Industry; and

- Security Industry.

We discuss each of these industries in more detail below.

Interestingly, the Industrial Relations Minister, Natalie Hutchins, remarked in her second reading speech that the LSBP Act has been drafted in such a way as to allow other industries to be included in the scheme in the future, should the Government determine this to be appropriate.

- Community Services Sector

The Community Services Sector will cover an employer if they are:

- a “non-profit entity” that employs one or more individuals to perform community service work;

- “an entity for profit” (i.e. a corporation) that employs one or more individuals to perform community service work for persons with a disability; or

- a person who is, or is a member of a class, prescribed to be an employer for the Community Services Sector.

An eligible employee is an individual employed by an employer in the Community Services Sector. The LSBP Act does, however, provide some exclusions including for example, workers whose primary role is to provide health services to persons with disabilities or to whom the Aged Care Award 2010 applies.

The definition of community service work is broad, and includes the following work performed for persons with a disability, or who are vulnerable, disadvantaged, or in crisis:

- training and employment support;

- financial or goods for assistance;

- accommodation or accommodation-related support services; or

- home care support services.

Community service work also extends to various other support services such as those for persons or their carers, community legal or education services, and fundraising services.

Community service work does not include:

- an activity that is funded by the National Disability Insurance Scheme within the meaning of the National Disability Insurance Scheme Act 2013 (Cth); or

- a service provided by an entity that is a licensed children’s service under the Children’s Services Act 1996 (Vic) or an approved provider under the Education and Care Services National Law (Vic),unless such a service, or class of service, is prescribed to be community service work.

Further, the scheme does not apply to local government community services, so it does not affect the portable long service leave scheme which already applies in that sector.

- Contract Cleaning Industry

The Contract Cleaning Industry includes an employee performing cleaning work such as:

- work that has as its only or main function, the bringing of premises into, or keeping of premises in, a clean condition; or

- an activity, or an activity of a class, prescribed to be cleaning work.

Cleaning work does not include:

- the removal of waste from commercial waste receptacles;

- the bringing of grounds surrounding building or house into, or keeping the grounds in, a clean condition;

- work of a cleaning nature performed on a building or house under construction; or

- work of a gardening nature, including the removal or alteration of vegetation.

Employers excluded from coverage in respect to cleaning work under the LSBP Act include the Commonwealth and State Governments and municipal councils.

- Security Industry

The Security Industry includes work undertaken by persons licensed under the Private Security Act 2004 (Vic) performing security work.

Security work includes activities such as:

- protecting, guarding or watching property;

- acting as a bodyguard;

- acting as a crowd controller;

- installing, servicing or repairing security equipment; or

- providing training in relation to private security.

The following are examples of activities that would not be security work:

- installing a lock as part of work as a builder;

- cutting unrestricted keys;

- operating a prison or other correctional facility; or

- selling self-install security systems.

Similar to the Contract Cleaning Industry, employers excluded from coverage in respect to security work under the LSBP Act include the Commonwealth and State Governments and municipal councils.

Summary of key provisions

- Establishment of Statutory Authority

The LSPB Act establishes the Portable Long Service Benefits Authority (Authority) (which will operate similar to CoINVEST in the construction industry) and will administer and make payments under a portable long service benefits scheme in covered industries. The Authority will have a governing body known as the Portable Long Service Benefits Governing Board.

- Entitlement

After seven years’ service, an eligible employee will be able to apply to the Authority for a cash payment of a long service benefit equal to 1/60th of their total period of recognised service, less any long service benefit paid during that period.

- Registration

The Authority will keep an employers register and a workers register for covered industries. An employer in a covered industry will be required to register themselves and their workers.

- Returns

Employers that fall within the scope of the scheme will be required to make quarterly returns to the Authority, which includes providing details about employees who performed work during the quarter.

- Levy

In order to fund the scheme, the Governing Board of the Authority will set a levy. It is not yet known what the employer’s levy will be, other than that it will not be more than 3% of an employee’s ordinary pay. Employers will be required to report to, and pay this levy to, the Authority for each employee of the employer in the relevant quarter. Penalties (plus interest) for failure to pay the required levy will apply.

- Contracting Out

The LSBP Act does not allow for a contract of employment, or agreement of any kind, to ‘contract out’ any of its provisions.

- No Double Dipping

The LSBP Act provides that a worker is not entitled to both long service leave under a Fair Work Act instrument (e.g. modern award or enterprise agreement) and payment of a long service benefit under the LSBP Act in respect of the same service period.

- Failure to keep proper records

Failure to keep a long service record relating to a worker during the worker’s service with the employer will constitute an offence for which a penalty may be imposed against an employer. Additionally, long service leave records must be kept for a period of 7 years.

Although the specifics of the LSBP Act are yet to be finalised, covered employers need to prepare now for the introduction of the scheme and ensure that they are appropriately taking into account what will be for some employees a new benefit in practice. Please contact our Employment Advisory Team for more information.

Authored by:

Natasha Horvat, Senior Associate

Stacey Devitsakis, Lawyer