Vacant Property Tax in Victoria

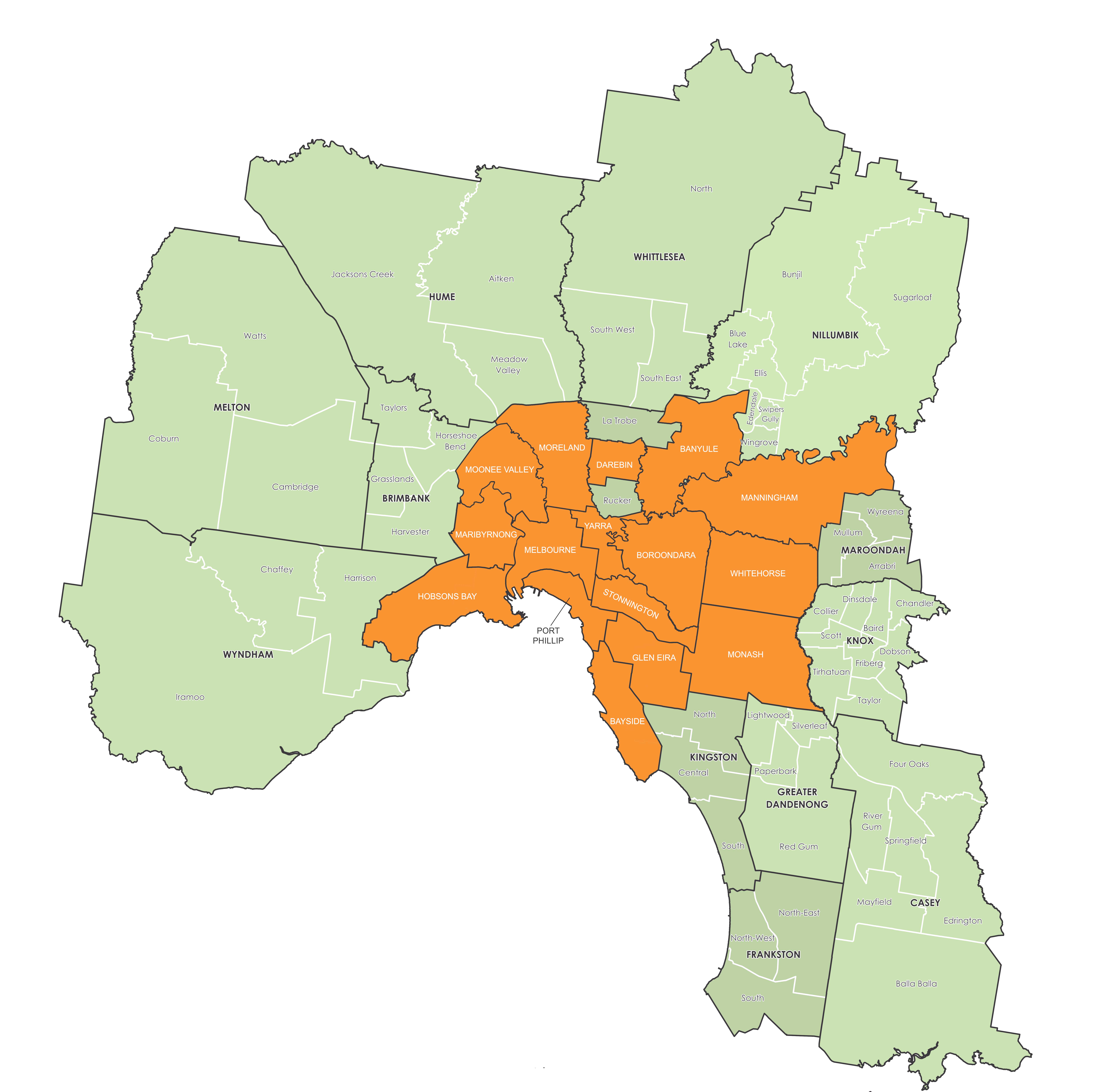

From 1 January 2018 a vacant residential property tax will be introduced in Victoria. The purpose of the tax is to discourage owners having properties vacant for a cumulative period longer than 6 months within a calendar year. The tax is limited geographically to properties located in the following Councils as highlighted in orange below:

(Click here to view the full size image)

This tax is part of the Victorian government’s initiative to deliver affordable housing. It is designed to encourage owners to make their property available for purchase or rent in Melbourne and surrounding areas, where the issue of housing affordability is most pressing.

How will the tax work?

The tax will be incorporated into the land tax legislative framework and it will rely on self-reporting. Property owners will be expected to inform the State Revenue Office when their property triggers the tax.

It is likely in the future there will be some monitoring undertaken by the SRO to ensure compliance. One indicia that a property is vacant for a substantial period is the lack of water or electricity being consumed by the property.

The tax will be calculated based on 1% of the capital improved value of the property.

Will a mortgagee in possession be liable for the tax?

No. The Bill introducing the amendments to the Land Tax Act (Vic) 2005 (Act) has been recently passed by the Victorian parliament. Pleasingly there will be a specific exclusion for mortgagees in possession, who are deemed an owner of land under section 17 of the Act. To be inserted into the Act will be section 34E which will provide:

“(2) A mortgagee in possession who is deemed by section 17 to be an owner of VRT land is not liable to pay vacant residential land tax on the land.”

Take out

All property owners in Melbourne and its identified surrounding suburbs should be aware of the introduction of the vacant residential property tax on 1 January 2018.

Mortgagees in possession are specifically excluded from being liable for the vacant residential property tax. Due to this mortgagees in possession do not need to account for this tax to the State Revenue Office and can proceed in their usual course of business when conducting mortgagee sales.