Small Business Insolvency Reforms – What this means for SME businesses as COVID restrictions ease and into the future

Following Treasury’s announcement on 24 September 2020 that it will introduce a suite of reforms to Australia’s insolvency framework, the Corporations Amendment (Corporate Insolvency Reforms) Bill 2020 (Cth) (Draft Bill) was released for public consultation between 7 and 12 October 2020, providing much needed clarity as to the practical effect of the insolvency reforms, which are expected to commence on 1 January 2021.

The reforms are expected to assist in preventing an anticipated influx of insolvencies and to help struggling small businesses survive following the expiration of temporary COVID-19 relief measures on 31 December 2020.[1]

Whilst key elements of the reforms will be dealt with under associated regulations, which are yet to be released, this article provides an overview of the Draft Bill and considers what the reforms might mean for small and medium size businesses as COVID restrictions ease and into the future.

The Draft Bill seeks to insert a new Part 5.3B to the Corporations Act 2001 (Cth), incorporating three key elements:

-

- a streamlined debt restructuring process (Streamlined DRP) for eligible small businesses;

- a simplified liquidation pathway; and

- additional measures to support the insolvency sector to respond to the reforms.

Streamlined Debt Restructuring Process (Streamlined DRP)

The Streamlined DRP aims to provide simplified, faster means for eligible, financially distressed but rescuable businesses to restructure their existing debts. This will be achieved by the appointment of a small business restructuring practitioner (SBRP) to advise the eligible business on the restructure process and, if approved by creditors, to assist in implementation of a restructuring plan.

The Draft Bill provides that registered liquidators will be permitted to be appointed as a SBRP.[2] A new class of registered liquidator will be established under the Insolvency Practice Rules. Further detail about the registration of SBRPs is to be included in the draft regulations which are yet to be released.

Treasury initially announced that the Streamlined DRP would be available to incorporated businesses with liabilities of less than $1 million. The manner in which the company’s liabilities are to be calculated will be clarified by the draft regulations.

What is clear from the Draft Bill is that a company will not be eligible to appoint an SBRP for the purposes of the Streamlined DRP if:

- the company is already under restructuring;

- the company is under administration;

- the company has executed a deed of company arrangement that has not yet terminated;

- a person has been appointed as liquidator, provisional liquidator or administrator of the company; or

- any person who is a director or has been a director of the company within the 12 months prior, has been a director of another company that has been under restructuring or the subject of a simplified liquidation process within a period to be prescribed by the regulations.

Significantly, and in contrast to the rigid ‘creditor in possession’ model that applies where an administrator or liquidator is appointed, the Streamlined DRP will adopt a ‘debtor in possession’ model, which will allow the company’s existing directors to remain in control, and the business to carry on trading in the ‘ordinary course of business’[3].

Once it is determined that the business is eligible, the company may appoint a SBRP by board resolution to the effect that the directors voting have reasonable grounds to suspect the company is insolvent or is likely to become insolvent at some future time and a SBRP should be appointed.[4] The SBRP will work alongside the existing company officers to provide advice to the company on matters relating to restructuring, assist the company to prepare a restructuring plan, make a declaration to creditors in relation to a restructuring plan proposed to creditors and any other functions given under the Act.[5]

A director of a company under restructuring is required to give the SBRP information about the company’s affairs and allow the SBRP to take copies of the company’s books, including where the books are held by a third party.[6]

The Draft Bill indicates that the contents and details surrounding a restructuring plan will be clarified by the regulations, including:

- as to proposing a restructuring plan;

- accepting and rejecting a proposal for a restructuring plan;

- variation and termination of a restructuring plan;

- debts and claims that must be dealt with;

- property that may be used in payment of debts and claims;

- the nature and duration of any moratorium on the enforcement of debts and claims against a company under a restructuring plan; and

- the appointment of an SBRP.[7]

Enforcement of security interests

Upon the appointment of the SBRP, the company must give notice on all public documents and negotiable instruments by adding ‘(restructuring practitioner appointed)’ after its name. Certain protections will then apply to the company, similar to those that apply in a voluntary administration, including:

- the prohibition on unsecured and some secured creditors taking action against the company unless the SBRP has consented or leave is granted by the Court;

- personal guarantees provided by a director or their relatives may no longer be enforced without leave of the Court; and

- protection from ipso facto clauses allowing creditors to terminate contracts due to an insolvency event, by operation of a ‘stay period’ which begins when the company enters restructuring and ends when the Streamlined DRP concludes.

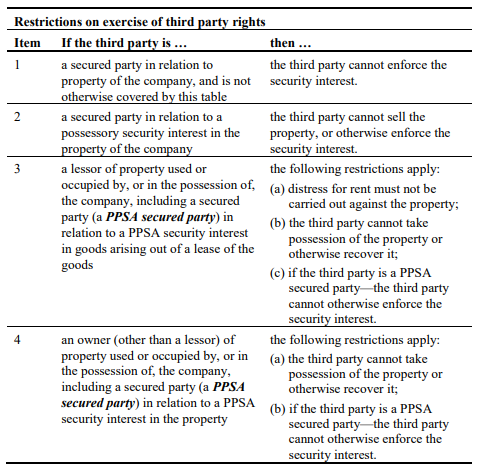

Section 453Q of the Draft Bill sets out the proposed restrictions on the exercise of third party rights against a company under the appointment of an SBRP.

The Draft Bill provides that no enforcement process in relation to the property of the company can be commenced or proceeded with whilst a company is under restructuring, except with leave of the Court[8].

However, section 454C of the Draft Bill establishes an exception to this, by providing that a secured creditor with a security interest that is perfected within the meaning of the Personal Property Securities Act 2009, over the whole, or substantially the whole of the property of the company, either by one or multiple security interests, is entitled to enforce the interest if it does so before or during a 13 business day ‘decision period’. The ‘decision period’ begins when the secured party receives notice of the debt restructuring process or when the restructuring process begins and ends thirteen business days later. There are also exceptions established with respect to instances where recovery of property begins before restructuring, with such rights able to be limited by Court order.[9]

In addition, a right cannot be enforced against a company due to the company being under restructuring or due to the company’s financial position if the company is under restructuring.[10] The Court will be empowered to order that this stay does not apply if satisfied it is in the interests of justice.[11]

Extension of Safe Harbour Provisions

The Draft Bill provides for the insertion of a new section 588GAAB, extending the safe harbour provisions to provide that s588G(2) does not apply to debts incurred during the restructuring of the company and in the ordinary course of the company’s business or with the consent of the restructuring practitioner or order of the Court.

Simplified Liquidation Process

For eligible small businesses that cannot be revived, a new, simplified liquidation process will be made available to allow for faster and lower cost liquidation.

Whilst a liquidator will still take control of the company and its assets for distribution to creditors, the Draft Bill confirms that the simplified liquidation pathway will only be available in a creditor’s voluntary liquidation.

For a company to be eligible for the simplified liquidation pathway, the directors of the company must make a declaration to the effect that they believe on reasonable grounds that the eligibility criteria for the simplified liquidation process are met. A liquidator must then be satisfied on reasonable grounds that[12]:

- the company has passed a special resolution that the company be wound up voluntarily;

- a report on the company’s affairs under section 497(4) must have been provided to the liquidator as well as a declaration of eligibility under section 498;

- the company will not be able to pay its debts in full within a period not exceeding 12 months after the day on which the triggering event occurs;

- any relevant test in the regulations is satisfied;

- the company’s tax obligations have been complied with; and

- no person who is a director or has been a director of the company within the 12 months prior, has been a director of another company that has undergone restructuring or been the subject of a simplified liquidation process within a period prescribed by the regulations.

In the interests of time and efficiency, the simplified liquidation process features reduced reporting requirements whereby the liquidator is not required to report to creditors under section 533 of the Corporations Act as to whether there are reasonable grounds to believe misconduct has occurred or whether the company may be unable to pay its unsecured creditors more than 50 cents in the dollar.[13]

The requirement to hold creditor meetings under the Insolvency Practice Rules has also been removed under section 500AE(2) for the simplified liquidation process. Voting processes and information may instead be provided to creditors electronically.[14]

Further details surrounding the simplified liquidation process will be clarified by the regulations, including in relation to unfair preference claims and voidable transactions.

Permanent changes to creditor communications

Notably, the Draft Bill seeks to permanently amend the circumstances in which documents relating to a company’s external administration can be provided electronically, including by allowing for the electronic signing of documents.

These changes will apply to documents required or permitted to be given under:

- Chapter 5 of the Corporations Act (dealing with external administration);

- the Insolvency Practice Schedule (Corporations) in Schedule 2 to the Corporations Act;

- Chapter 5 of the Corporations Regulations (dealing with external administrations);

- the Insolvency Practice Rules (Corporations) or any other instrument made under Chapter 5 of the Corporations Act or the Insolvency Practice Schedule (Corporations); and

- a transitional provision that relates to the external administration rules in Chapter 10 of the Corporations Act or an instrument made under Chapter 10.

Treasury’s announcement on 24 September indicated that up until 31 March 2020, an eligible business may declare its intention to access the restructuring process to creditors, following which the existing temporary insolvency relief would apply for a maximum of 3 months, until the business is able to access a SBRP. No further information on these temporary relief measures has been provided to date.

Key Take outs

-

- The Streamlined DRP and simplified liquidation pathway is expected to reduce the burden placed on insolvency practitioners during the ‘wave of insolvencies’ that is anticipated when the temporary changes to insolvency laws cease on 31 December 2020.

- Only registered liquidators may act as a SBRP.

- Eligibility requirements for the Streamlined DRP and simplified liquidation process are still to be confirmed by the regulations.

- Upon appointment of a SBRP, unsecured and some secured creditors will be prohibited from taking action against the company including enforcing security interests and guarantees against directors or their relatives without leave of the Court, other than pursuant to specific exceptions.

- A secured creditor with a security interest over the whole or substantially whole of the property of the company may still enforce its security interest, if it does so before the ‘decision period’.

- The simplified liquidation process will only be available in a creditor’s voluntary liquidation.

Gadens can assist organisations prepare for commencement of the new insolvency reforms, including by conducting training for practitioners and creditors on the new framework or referring distressed businesses to appropriate solutions. Get in touch.

Authored by:

Nicholas McKenzie-McHarg, Partner

Robert Hinton, Partner

Natalie McCabe, Senior Associate

Katie White, Lawyer

[1] These temporary measures were initially introduced in March 2020 for a period of 6 months and in September 2020 were extended by a further 3 months until 31 December 2020.

[2] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 456B

[3] The SBRP must give prior approval for trading that is outside the ordinary course of business, with such consent only to be given if the SBRP believes on reasonable grounds that it would be in the interests of creditors to enter into the transaction or dealing. Such consent may be given subject to conditions, see s453L of the Draft Bill.

[4] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 453B

[5] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 453E

[6] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, ss 453F and 453G

[7] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 455B

[8] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 453S

[9] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, ss 454K and 454M

[10] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s454P

[11] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 454Q

[12] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, ss 498 and 500AA

[13] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 500AE(2)(a)

[14] Corporations Amendment (Corporate Insolvency Reforms) Bill 2020, s 600G