New Mandatory Merger Control Regime Promises Balanced Reform

The Federal Government’s eagerly anticipated position on reforming Australia’s merger laws was released on 10 April, which it will seek to legislate with effect from 1 January 2026. Should the reforms be implemented as envisaged, we expect it to result in:

- greater certainty as to when notification to the Australian Competition and Consumer Commission (ACCC) is necessary;

- more transactions being notified to the ACCC;

- the clearance process being less opaque, and the vast majority of notified transactions proceeding through the approval process relatively quickly; and

- participants in more concentrated and/or dynamic markets likely to have greater difficulty expanding by merger or ‘bolt-ons’.

Why is reform being pursued?

Over the years, and also in response to the Government’s merger control consultation process, the ACCC has raised concerns that the current merger control regime is not effective and that the ACCC is unable to assess and challenge proposed transactions that raise competition concerns effectively as a result of:

- the voluntary informal clearance process, which leads to some parties choosing not to give notice to the ACCC;

- in the absence of notification, potentially unlawful anti-competitive transactions proceeding to completion with the ACCC’s only means to challenging the transaction being through enforcement action after the event and where it gains knowledge of it;

- notwithstanding notification, parties nevertheless being able to complete the transaction before the ACCC has concluded its assessment without taking interim enforcement action (i.e. ‘gun jumping’); and

- parties providing insufficient or inaccurate information to the ACCC to allow the ACCC to properly carry out its assessment.

What are the key elements of the proposed reform?

Mandatory and suspensory approval process

All transactions above a threshold will require notification to the ACCC. It will be unlawful for the transaction to proceed in the absence of approval from the ACCC. The ACCC will be able to prevent a notified transaction from proceeding if it reasonably believes that the transaction will have the effect, or be likely to have the effect, of substantially lessening competition.

ACCC to be the single channel

The Government has backed the ACCC as the more appropriate decision-maker, and will prevent parties bypassing the ACCC to seek declarations from than the Federal Court. A decision of the ACCC will nevertheless remain open to challenge before the Australian Competition Tribunal.

Thresholds for notification

The thresholds at which notification must occur will be both monetary in nature (e.g. turnover, profitability or transaction value) and share of market/supply, however the exact thresholds have yet to be decided by the Government – it will consult further throughout this year on what those thresholds should be. The ACCC had indicated in its submissions that an acquirer or target turnover threshold of $400 million or global transaction value threshold of $35 million could be appropriate. As to market share, the ACCC currently encourages transactions where the merged firm will have a post-merger market share of greater than 20% to engage with the ACCC.

Though Treasury anticipates that the thresholds will be set such that the ACCC will be dealing with a similar number of notifications as it does now, the question of thresholds will be a closely watched development because these will have very different impacts, depending on where they are set, on what must be notified even if there were no inherent competition concerns.

For transactions below the thresholds, it will be optional for parties to submit the transaction voluntarily to the process. While the Government has elected not to give the ACCC the power to ‘call in’ and assess prospective transactions unilaterally on a discretionary basis, the ACCC will continue to have the ability to investigate mergers that haven’t been notified for contraventions of other provisions of the Competition and Consumer Act 2010 (Cth).

‘Creeping acquisitions’

In considering whether notification thresholds are met, regard will be had to the transactions in the previous three years of each of the acquirer and the target (irrespective of whether those transactions were themselves individually notifiable). This seeks to ensure that serial or creeping acquisitions and “roll up” strategies, where a single transaction on its own does not meet the threshold but a sequence of aggregated transactions may do so, are placed on the ACCC’s radar.

Information provision and gathering

In order for the ACCC to be able to make a fully informed decision, steps will be put in place to encourage fulsome and tangible information. Under threat of penalty, senior executives or directors of merger parties will need to certify or attest that the information provided is true, accurate, complete and correct.

Notably, the ACCC’s compulsory information gathering powers will be extended to enable it to gather all relevant information and evidence. The existence of this power should mean that merger parties are encouraged to be fulsome in the information that is submitted to the ACCC with the application and through the approval process.

End of the ‘informal clearance’

If the mandatory notification regime is introduced, this will also spell the end of the ‘informal’ merger clearance process.

How will the mandatory process work?

What is proposed will be familiar to many who have worked on transactions in a number of other OECD countries.

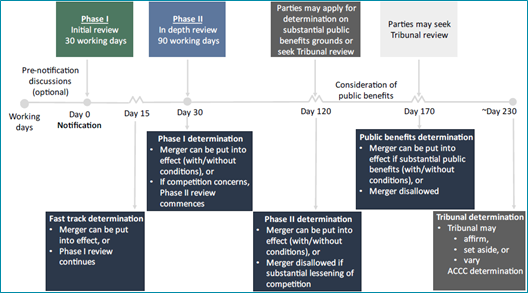

Phase I

The timelines provided in Treasury’s paper are indicative only at this stage, and will be the subject of consultation this year. As currently presented, ‘Phase I’ (the initial review) would require a notification to be lodged and the transaction not complete for 30 business days (though the ACCC will have the power to extend the timeline – for example, where requested information is not supplied in time). If the ACCC does not identify relevant competition concerns (see “Competition test” below), the transaction may thereafter complete.

The paper also anticipates a ‘fast track’ process whereby matters with no concerns can be processed by the ACCC in 15 business days. Instances such as no overlap or specified public interest criteria may be examples of circumstances to justify use of the truncated 15 day period. It is not immediately clear how the that ‘fast track’ process would be determined to operate – for example, it is not clear that the ACCC would be obliged to commit certain applications to the ‘fast track’ process.

The Government has indicated that all merger notification will be accompanied by a fee and that the ACCC should charge filing fees applying cost recovery principles. While Treasury is estimating fees will be in the range of $50,000 to $100,000 (but with an exemption process for small business), we believe that a significant proportion of that fee should only be payable if a transaction were to proceed to Phase II (see below). Treasury will consult further this year on the issue of fees.

Phase II

If a transaction were to raise concerns for the ACCC, the ACCC would issue a notice of ‘competition concerns’. If the parties did not abandon the transaction at that point or agree to behavioural or structural remedies at that stage, the transaction would be subjected to a Phase II assessment, which would likely involve in-depth economic and legal analysis. At that time, the ACCC would publicly announce the Phase II review and issue the notice of competition concerns. Phase II is slated to last up to 90 business days.

‘Substantial Public Benefits’ test

If the ACCC concludes in Phase II that the transaction would have the effect, or likely have the effect, of substantially lessening competition, the parties may apply to seek the ACCC’s approval for the transaction under the ‘Substantial Public Benefits’ test, where the merger parties seek to satisfy the ACCC that, notwithstanding the competition concerns, the merger would, or is likely to, result in a substantial benefit to the public that outweighs the anti-competitive detriment of the merger.

At present, an indicative timeline for this process is 50 business days but this issue will be the subject of further consultation this year. An indication of timelines, as presented in the Government’s response, is set out below.

Source: The Australian Government, the Treasury

Australian Competition Tribunal

A decision of the ACCC in Phase II not to allow a transaction, or a decision of the ACCC not to approve a transaction under the ‘substantial public benefits’ test, will be capable of review by the Australian Competition Tribunal.

In essence, the Tribunal would be asked to step into the shoes of the ACCC, consider the evidence that was before the ACCC, and affirm, set aside or vary the ACCC’s determination.

As is the case with Tribunal reviews of ACCC authorisation decisions, the Tribunal would be limited conducting its review within 90 days, extendible by a further 90 days where necessary.

Judicial review of the Tribunal’s decision would be available as well.

Competition test

Substantially lessening competition

The underlying legal test for whether a transaction is unlawful will continue to be whether the transaction will have the effect, or be likely to have the effect, of substantially lessening competition.

The law will state that transaction must be allowed to proceed unless the ACCC reasonably believes that the transaction will have the effect, or likely to have the effect, of substantially lessening competition in any market. Notably, it will be made clear that this assessment can take into account the effect of the transaction in creating, strengthening or entrenching a position of substantial market power in any market.

The Government has refused the ACCC’s request that the burden be shifted to the notifying parties to show that the merger is not likely to have the effect of substantially lessening competition. Instead, the Government believes a better equipped ACCC will be adequate to assess competition risks and, as applicable, take preventative measures.

‘Creeping acquisitions’

In considering the effect on competition, the transactions in the previous three years of each of the acquirer and the target (irrespective of whether those transactions were themselves individually notifiable) may also be expressly considered. This seeks to prevent serial or creeping acquisitions and ‘roll up’ strategies where a single transaction on its own does not lead to competition concerns but a sequence of aggregated transactions may do so. This may be particularly relevant to dynamic industries where technology or intellectual property might be pivotal.

What does this mean for business?

If implemented effectively, the proposed merger control regime will align Australia with international practice and be an important contribution to an informed, efficient and competitive economy, as well as provide better signals for industrial policy formation.

The proposed merger controls should provide greater certainty as to when a transaction should be notified to the ACCC. There will be less guesswork about defining markets and market share at the outset, so the decision whether or not to notify should be become binary.

However, the biggest unknowns at this stage are the notification thresholds and the ACCC’s capacity to operate the proposed “fast track” system effectively. While there is the potential for more transactions to be notified to the ACCC under the new regime, a significant number of them would presumably be transactions that do not raise competition concerns and that should either be able to progress through “fast track” or otherwise have concerns adequately addressed in Phase I. In which case, the new merger control regime should not be a significant imposition on businesses with respect to transactions that would not otherwise be expected to participate in the current informal clearance process. The ACCC will need to have the resourcing to ensure this can occur effectively – this new regime cannot afford to be a handbrake on uncontroversial transactions.

As noted, there will be further consultation by the Government this year on the issues of thresholds, fees and procedural safeguards, and into 2025 on the form of notification. We will watch these developments with interest.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Adam Walker, Partner

John Kettle, Partner

Oskar Henderson, Paralegal