New Australian mandatory merger control legislation introduced – Further clarity on the path ahead

In the biggest ever reform of Australia’s merger control laws (see our earlier Insights here and here), the Treasury Laws Amendment (Mergers and Acquisitions Reform) Bill 2024 (Bill) was introduced in the House of Representatives on 10 October and will now work its way through the Parliamentary process with an expectation of the Bill becoming law by the end of the year, with stepped effect from 1 July 2025.

Executive summary

The result of these reforms will be:

- a mandatory merger control notification regime will apply to:

- transactions that meet the relevant monetary turnover thresholds;

- transactions involving businesses that are subject to a Ministerial class determination;

- a failure to comply with the notification regime will cause the acquisition to be void;

- Phase 1 and Phase 2 investigation processes with specified timelines;

- a new ‘notification waiver’ regime, which has similarities to the current informal merger clearance process, suitable for uncontroversial transactions that may otherwise have to be notified (like a safe harbour exception); and

- limited recourse to the Australian Competition Tribunal to review the Australian Competition and Consumer Commission’s decisions in relation to merger control notifications.

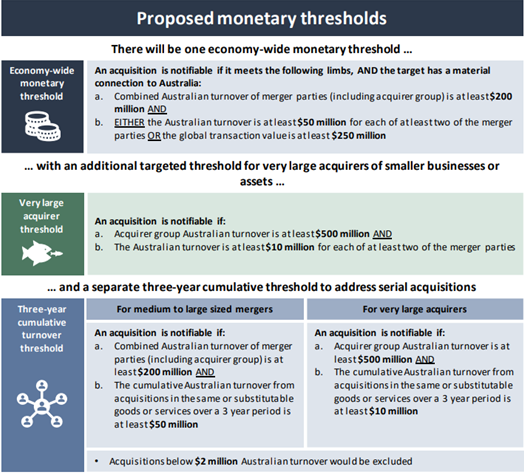

These are the initial monetary thresholds proposed along with the Bill triggering mandatory merger control notifications:

Source: The Australian Government, the Treasury

In relation to the ‘class determination’ trigger, the proposals have the potential to capture a significant volume of transactions falling short of a change of control in ownership of a company in a notification being triggered where an acquirer obtains more than a 20% interest in an unlisted or private company if one of the companies involved in the deal has turnover more than $200 million.

The current test prohibiting of acquisitions that have the effect, or likely effect, of substantially lessening competition, found in section 50 of the Competition and Consumer Act 2010 (Cth), will be retained.

The new regime is slated to take effect from 1 January 2026 but will apply voluntarily from 1 July 2025.

With some marked changes from the Government’s original proposition and its exposure draft of the legislation, businesses should familiarise themselves with the proposed thresholds and class determinations, which may add an additional layer of compliance to certain transactions.

This new Australian regime will align Australian merger control procedures with those of many other OECD countries. The introduction of turnover thresholds will enable a more transparent and effective initial analysis to determine applicability, and the statutory introduction of this more orthodox review process will be easier to understand and translate particularly for overseas investors.

More detailed analysis

What are the key elements of the merger control reform presented in the Bill?

Mandatory and suspensory approval process

All transactions above the specified thresholds, or that otherwise fall within the scope of a class determined by the Minister, will require prior notification to the Australian Competition and Consumer Commission (ACCC) and will not be allowed to proceed without approval from the ACCC. The obligations in this regard will apply to the ‘principal party’, which, for the most part, will be the acquirer in the relevant transaction.

A failure to comply with this regime:

- will cause the acquisition to be rendered void; and

- could expose parties to penalties if successfully prosecuted, including, where shares have been unlawfully acquired and not disposed within the requisite period required by the Tribunal, criminal sanctions.

Gun-jumping will not be tolerated.

Notification waiver

In a notable development since the original proposal, the ACCC will be empowered to grant waivers from complying with the mandatory notification obligation. This is like a safe harbour exception.

The parameters for being granted a waiver are to be set out in a legislative instrument, the details of which have not yet been released, but the ACCC will need to take into account, among other things, the interest of consumers, whether the notification thresholds would be met, and the likelihood of the acquisition having the effect of substantially lessening competition.

As is the case with the current informal clearance regime, a waiver from the ACCC will not grant immunity from the application of the general prohibition in section 50. The waiver will merely mean that the mandatory notification process does not need to be followed.

For those familiar with the current informal clearance process, this notification waiver process could potentially be attractive for a transaction that, despite meeting the notification threshold, the parties are comfortable is unlikely to have the effect of substantially lessening competition. That said, an answered question is how burdensome the waiver application process itself will be, given that the ACCC will need to take account of various considerations, including the effect on competition, before granting a waiver.

Publication and confidential reviews

The ACCC will maintain a public register of notified acquisitions including, within one business day from when the relevant determination, decision or notification is made, a copy of the acquisition determination, statements of the ACCC’s reasons for making the determination, a copy of the notice stating that a notification is subject to Phase 2 review, and any other details as required in a legislative instrument.

However, in response to concerns about the impact of the timing and public nature of the mandatory suspensory process on surprise hostile takeover bids and certain voluntary transfers under the Financial Sector Transfer and Restructure Act 1999 (Cth), the Bill now also provides for the possibility of a limited confidential review. In the case of hostile takeovers, an application may be made that, subject to certain conditions, the review will not be published for until 17 business days after the effective notification date. In the case of voluntary transfers, a confidential review may be conducted and determined within less than the usual minimum of 15 business days.

Thresholds for notification

While the Bill itself does not contain the notification thresholds, the Government has flagged in its consultation response paper the notification obligations it intends to set by legislative instrument. It intends to consult on further detail on the notification thresholds through the development of legislative instruments into 2025.

- Notification thresholds

In a notable change to the original proposal, the Government has elected not to proceed with a market share threshold. Rather, the general notification thresholds will be by reference to monetary turnover thresholds, being each of the following:

-

- Economy-wide threshold: An acquisition will be notifiable if:

- the target carries on, or has plans to, carry on business in Australia; and

- the Australian turnover of the combined businesses (including the acquirer group) is above $200 million; and

- either the business or assets being acquired has Australian turnover above $50 million or there is a global transaction value above $250 million.

- Very large acquirer threshold: An acquisition will be notifiable if:

- the acquirer group has Australian turnover of more than $500 million (a very large business); and

- the Australian turnover for each of at least two of the merger parties is at least $10 million.

- Cumulative turnover threshold: To capture ‘creeping’ and serial acquisitions, an acquisition will also be notifiable if:

- the combined Australian turnover of merger parties (including the acquirer group) is at least $200 million, and the cumulative Australian turnover from acquisitions in the same or substitutable goods or services over a three-year period is at least $50 million; or

- the acquirer group is a very large business, and the cumulative Australian turnover from serial acquisitions is at least $10 million.

- Economy-wide threshold: An acquisition will be notifiable if:

Acquisitions involving an undertaking below $2 million Australian turnover would be expressly excluded.

- Class determination

In addition, the Minister will have the ability, by legislative instrument, to determine classes of other transactions that will be subject to mandatory notification.

Supermarkets: The Government has indicated that it intends to utilise this power to require every merger in the supermarket sector be subject to the mandatory regime. Further detail on what transactions in the sector will be captured will come to light once the consultation drafts of the proposed legislative instruments are made available for comment.

20% interest in unlisted and private companies: The Government has also indicated that it will require acquisitions that result in the acquirer holding more than a 20% interest of an unlisted or private body corporate to be notified if one of the companies involved in the deal has turnover more than $200 million.

Liquor, pathology and oncology-radiology. In separate reporting, the ACCC has also flagged that, due to concerns about concentration and serial acquisitions and roll-ups, it will ask the Treasurer to designate also each of the liquor, pathology and oncology-radiology sectors as being subject to mandatory notification.

What transactions are caught or expressly excluded?

- What’s in?

But for some limited exceptions, if the transaction parameters meet the notification thresholds, the acquisition of any shares or assets will be subject to the mandatory regime. Acquisitions of assets include those involving: any kind of property; a legal or equitable right that is not property; a part of, or an interest in, either; legal or equitable interests in tangible assets, such as options in land; intangible assets, such as intellectual property rights or contractual rights such as leases; goodwill or an interest in it; an interest in a partnership or an asset of a partnership.

In addition, the Minister will have the power to make determinations broadening the transaction structures that may not otherwise be caught in the ordinary course – for example, where control is obtained by a combination of partial shareholding and management agreements.

- What’s excluded from the notification obligation?

Acquisitions of shares not giving control (with a significant exception): Acquisitions of shares that do not result in a person gaining control of the corporation will generally be excluded unless arising from a contrived scheme. However, as noted above, the Government is proposing, by legislative instrument, to require acquisitions that, subject to the monetary thresholds, result in the acquirer holding more than 20% voting power of a private company to be notified.

Listed and widely held entities: To align with takeovers thresholds, acquisitions that result in holding up to 20% of voting power in listed and widely-held entities to which Chapter 6 of the Corporations Act 2001 (Cth) applies will be excluded from the mandatory notification obligations.

Internal restructures: Internal restructures or reorganisations entities will generally not be within the scope of the acquisitions provisions as there is no change of control with these.

Land: In addition, land acquisitions will be exempt from notification unless, at this stage, captured by a class determination, where:

-

- the land is acquired from residential property development; or

- the land is acquired by a business primarily engaged in buying, selling or leasing property and does not intend to operate a commercial business (other than leasing) on the land.

Though these transactions will be expressly excluded from notification, they will remain subject to the general prohibition in section 50 of the Act to acquisitions that have the effect, or likely effect, of substantially lessening competition.

How will the notification process work?

The proposed phased approach to the notification and review process is adopted in this Bill but with some notable changes.

Phase 1

Consistent with the original proposal, ‘Phase 1’ (the initial review) would require a notification to be lodged and the transaction not complete for 30 business days (though the ACCC will have the power to extend the timeline – for example, where requested information is not supplied in time). If the ACCC does not identify relevant competition concerns (see ‘Competition test’ below), the transaction may thereafter complete.

While there remains the potential for a ‘fast track’ process, whereby matters with no concerns can be processed by the ACCC in as little as 15 business days, it remains unclear how that ‘fast track’ process would operate and how the ACCC would be obliged to commit certain applications to the ‘fast track’ process.

It remains the expectation that application fees will be in the range of $50,000 to $100,000 (but with an exemption process for small business). Treasury will consult further on the issue of fees.

Phase 2

If a transaction were to raise concerns for the ACCC, the ACCC would issue a notice of ‘competition concerns’. If the parties did not abandon the transaction at that point or agree to behavioural or structural remedies at that stage, the transaction would be subjected to a Phase 2 assessment, which would likely involve in-depth economic and legal analysis. At that time, the ACCC would publicly announce the Phase 2 review and issue the notice of competition concerns. The ACCC is expected to give the notice of competition concerns within 25 business days of the commencement pf Phase 2 or as soon as practicable thereafter. Phase 2 is slated to last up to 90 business days.

Substantially lessening competition

The underlying legal test for whether a transaction is unlawful will continue to be whether the transaction will have the effect, or be likely to have the effect, of substantially lessening competition. The law will expressly state that an acquisition can be considered to have that effect if it would have the effect, or likely effect, of creating, strengthening or entrenching a position of substantial degree of power the market.

The transaction must be allowed to proceed unless the ACCC is satisfied that the transaction will have the effect, or likely to have the effect, of substantially lessening competition in any market.

Public benefits test

Unlike the original proposal, which would have lifted the standard to a substantial net public benefit, the proposed requirement for the public benefit to be ‘substantial’ has been dropped. Accordingly, if the ACCC concludes in Phase 2 that the transaction would have the effect, or likely have the effect, of substantially lessening competition, the parties may apply to seek the ACCC’s approval for the transaction under the ‘public benefits’ test, where the merger parties seek to satisfy the ACCC that, notwithstanding the competition concerns, the merger would, or is likely to, result in a benefit to the public that outweighs the anti-competitive detriment of the merger.

The ACCC has 50 business days from the effective application to date to make a public benefit determination unless the period is extended.

Australian Competition Tribunal

A decision of the ACCC in Phase 2 not to allow a transaction, or a decision of the ACCC not to approve a transaction under the ‘public benefits’ test, will be capable of review by the Australian Competition Tribunal. In essence, the Tribunal would be asked to step into the shoes of the ACCC and affirm, set aside or vary the ACCC’s determination. The Tribunal would be limited conducting its review within 90 days, extendible by up to a further 90 days where necessary.

In a concession from the original proposal, the Tribunal will not be limited to considering only the material put before the ACCC during the notification process. The Tribunal may permit notifying parties to provide information relevant to the ACCC’s determination and reasons if they were not given a reasonable opportunity, before the determination, to respond to the ACCC.

Other intermediate decisions of the ACCC, such as in relation to an effective notification date or effective application date, will also be reviewable by the Tribunal within 14 days of a review application being made.

What is the impact for business?

While some of the changes to the original proposal will be welcome, the ACCC’s expectation that it will see a similar number of notifications to the number of merger clearance requests it receives at present does have to be questioned.

Despite clarity in the general mandatory notification thresholds, the Government’s ability to subject other classes of acquisitions to the notification process – including the Government’s intention to require transactions involving one or more unlisted or private companies with a turnover above $200 million leading to an interest of 20% or more – has the potential for capturing many uncontroversial transactions.

This, in combination with the continued application of the general prohibition on acquisitions that substantially lessening competition, means that there will be transactions below the thresholds that would nevertheless benefit from being submitted to the ACCC as a notified acquisition.

In which case, the ACCC’s capacity to operate the proposed ‘fast track’ system effectively will be an important factor to the success of these reforms. The ACCC has set an expectation that 80% of merger swill be approved in 15 to 20 business days.

What’s next?

With the Bill now before Parliament, the Senate’s Economics Committee is taking submissions with a due date to report back to the Senate of 13 November. It is therefore possible that there may be amendments to the Bill before it finally passes into law, so there will be interest in the Bill’s passage through the legislature.

Further, the proposed legislative instruments with respect to the monetary notification thresholds, the supermarket class determination, other additional inclusions and exclusions from the regime; the notification waiver process, and the notification fees remain to be published. Likewise, the ACCC will be consulting on draft guidelines in 2025.

On current timelines, parties wishing to avail themselves of the current authorisation or informal clearance process for a transaction will have until the end of 2025 to obtain that authorisation or clearance, and must complete the transaction within 12 months of the authorisation or clearance. For transactions occurring in the second half of 2025, the new notification process will be available for use voluntarily and will likely be the necessary option from July 2025 onwards.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Adam Walker, Partner

John Kettle, Partner