Futureproofing Australia’s Payment System: Unveiling the Government’s Strategic Plan

The Australian Government has released its Strategic Plan for Australia’s Payments System (Strategic Plan). The Strategic Plan follows on from the Treasury’s Consultation Paper released in December 2022 and outlines a raft of proposed legislative and policy changes to the current payments system regulatory framework. The foreshadowed changes are significant and far-reaching and are aimed at building a modern and resilient payments system. Treasury has heralded the Strategic Plan as the biggest overhaul of Australia’s payments system in 35 years, positioning Australia as a leader in the global payments landscape.

With the majority of changes due to be implemented over the next 12-18 months, payment service providers and the broader FS market will be closely monitoring the Government’s rollout of the new regulations and policies that are set to reshape the future of the payments regulatory landscape in Australia.

Gadens provides an overview of the key changes below.

Overview

The Strategic Plan is an aspirational statement of the Government’s vision for the future of Australia’s payments system. That vision is to ensure that Australia has a ‘modern, world‑class and efficient payments system that is safe, trusted and accessible, and enables greater competition, innovation and productivity across the economy’. The vision encompasses a payments system supported by a modern and resilient regulatory framework that is fit‑for‑purpose, both now and into the future.

The Strategic Plan identifies five key priorities and objectives:

- promoting a safe and resilient system;

- updating the payments regulatory framework;

- modernising payments infrastructure;

- uplifting competition, productivity and innovation across the economy; and

- maintaining Australia’s leadership in the global payments landscape.

The Strategic Plan also outlines a set of overarching principles to guide the future direction of the payments system: trustworthiness, accessibility, innovation, and efficiency.

The primary objective behind the Strategic Plan is to ensure that Australia keeps pace with the rapidly evolving payments sector, particularly the increasing digitisation of payments systems and exponential advances in underlying technology, while also safeguarding the interests of payment providers and market participants.

Key changes

In its present form, the Strategic Plan is still in an embryonic stage. It could best be described as a statement of intent of the Government’s key priorities and initiatives for the future regulation of the payments system, and serves as a roadmap for the key changes over the next 12 – 18 months.

The majority of key changes are largely subject to further consultation and as such are not yet set in stone. Nevertheless, the plan includes some notable reforms which will be significant and far-reaching if ultimately implemented as proposed. These include:

- expanded regulatory powers for the RBA extending to all operators in the payments sector, including the New Payments Platform (NPP) and digital wallet providers;

- a new payments licensing framework under the Payment Systems (Regulation) Act 1998 (Cth);

- eliminating the use of cheques by or before 2030;

- transitioning away from the Bulk Electronic Clearing System (BECS) currently used for electronic funds transfers to the NPP; and

- a new tiered, risk-based licensing framework for ‘payment service providers’ (PSPs), based on a defined list of payment functions, which will replace the existing non-cash payments regime under the Corporations Act 2001 (Cth).

The Strategic Plan sets out a comprehensive statement of the key issues and proposed reforms. These are summarised in the table below:

| Objective | Issue | Proposed reforms |

|---|---|---|

| Promoting a safe and resilient system | Reducing the prevalence of scams and fraud |

|

| Strengthening defences against cyber-attacks |

|

|

| Supervising systematically important payment systems |

|

|

| Updating the payments regulatory framework | Implementing changes to the Payment Systems (Regulation) Act 1998 (Cth) (PSRA) |

|

| Establishing a new payments licensing framework |

|

|

| Enabling greater collaboration between payments system regulators |

|

|

| Reducing small business transaction costs |

|

|

| Modernising payments infrastructure | Phasing out cheques |

|

| Upgrading systems |

|

|

| Uplifting competition, productivity and innovation across the economy | Aligning payments system objectives and the Consumer Data Right (CDR) framework |

|

| Supporting the broader use of Digital ID and Digital Skills |

|

|

| Building public trust and confidence and supporting adoption of AI |

|

|

| Australia as a leader in the global payments landscape | Creating an environment that attracts and enables innovation |

|

| Facilitating cross border payments |

|

|

| Exploring the policy rationale for a central bank digital currency (CBDC) in Australia |

|

The roadmap

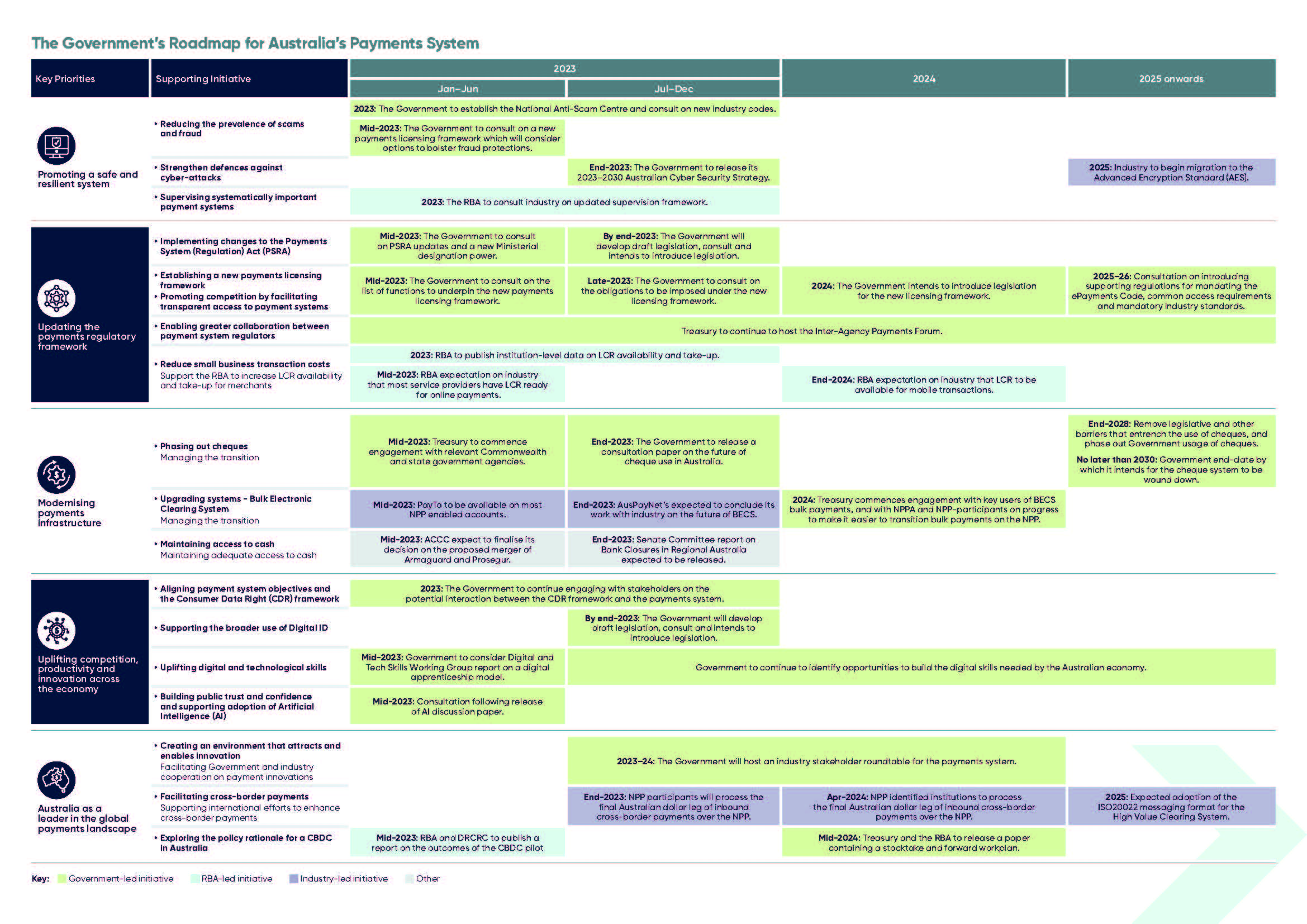

The Strategic Plan includes the Government’s roadmap which outlines the timeline for the rollout of the proposed changes:

Click on the image to view it full size.

Gadens insight

Those operating in the payments services sector will note that the Strategic Plan does not contain any materially new proposals. It is largely a repackaging of the announcements in Treasury’s previous Consultation Papers, most recently in December 2022. There is a little more colour provided nonetheless, in particular as regards the commitment to align and increase communication both between regulators and across ongoing legislative reforms impacting in adjacent areas, such as the CDR and on AI. Clarity on the timeline for the implementation of the revised payment systems licensing framework is also helpful for business.

The latest iteration of the planned changes is also an opportunity for payment providers and market participants to take guidance from the current Government as to its intentions for the future regulation of the sector, and reassess the potential impacts of these significant changes on their businesses. The Government is intent on future-proofing the regulatory architecture of the Australian payments system and these reforms are likely to have a significant impact on the future of innovation, as well as digital and technological advancement across the payments sector

The Government proposes to review and publish an updated Strategic Plan every 18 months – and will consult with industry stakeholders to support this review. Ongoing evaluation and adaptation to the reforms will be crucial to understanding and managing their impact effectively for all businesses active in the payment sector. Engagement in these consultation processes will give businesses a valuable opportunity to have their say on the shape of these reforms to come.

Payments Licensing – First Consultation process

As one of the first ‘cabs off the rank’ under the Strategic Plan, the Government is seeking input into the list of payment functions that are intended to underpin the new licensing framework for PSPs. The Payments System Modernisation (Licensing: Defining Payment Functions) Consultation paper (Licensing Consultation Paper) invites feedback on the foundations of a new tiered, risk-based licensing framework for PSPs, based on a defined list of payment functions and reflecting the recommendations of the Review of the Australian Payments System.

Further consultation on the regulatory obligations under the new licensing framework will take place later in 2023 with the introduction of legislation for the new payments licensing regime in 2024. Following the passage of legislation, detailed elements of the payments licensing reforms will be subject to further consultation. They include the design of supporting regulations for the ePayments Code, common access requirements, and mandatory industry standards.

Responses to the Licensing Consultation Paper are due by 19 July 2023.

Gadens will shortly be publishing a more in-depth article on the Licencing Consultation Paper and working with clients to assist them in making submissions on aspects affecting their payment products.

Gadens will continue to provide further updates as the roadmap is rolled out.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Sinead Lynch, Partner

Caroline Ord, Partner

Philip O’Brien, Senior Associate

Ray Mainsbridge, Paralegal