Australian Government releases draft merger control thresholds

The Australian Government has published its draft merger control thresholds which would trigger a mandatory merger control notification to the Australian Competition & Consumer Commission (ACCC) by relevant parties. These are likely to result in many more transactions being notified to the ACCC pursuant to the new processes the Australian Government will legislate to commence in 2025.

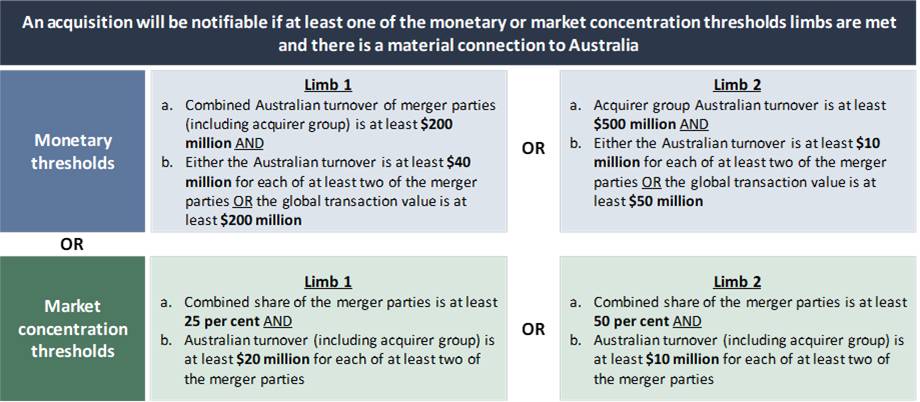

The proposed thresholds as set out in the consultation are:

Source: The Australian Government, the Treasury

For those with experience of merger control in European jurisdictions, the monetary thresholds and their calculation will look familiar. The market share thresholds are often more difficult to estimate – it is reasonable to expect that most transactions tripping the market share threshold will also probably trip the monetary thresholds too.

These thresholds are particularly relevant for private equity transactions and acquisitions by conglomerates or significant trading groups. More analytic work will be necessary at the start of any relevant transaction. This is not too different from the experience of many investors in other parts of the world and these merger control changes align Australia with most other leading economies.

The Government will issue the final decision on what the thresholds are in early 2025.

If you would like more information or assistance on the updates, please contact our team.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Adam Walker, Partner

John Kettle, Partner