Directors beware – personal recovery orders made where director’s duties breached

In the matter of Bryve Resources Pty Ltd [2022] NSWSC 647, the Court accepted the liquidator’s evidence of alleged breaches and found the company’s sole director breached his director’s duties, including failing to act with due care and skill, or in the best interest of the company and its creditors, when allowing the company to advance unsecured loan payments knowing the debtor was in no position to repay the loan. The liquidator also successfully claimed repayments of transactions made to, or for the benefit of, the director.

On 23 May 2022, the Supreme Court of New South Wales made orders against Mr Brent Stanton in his personal capacity, as well as Qube Logistics services (Pty) Limited, a company registered in Namibia (Qube) with Mr Stanton as the sole director. Williams J made orders against both Qube, as well as Mr Stanton, in favour of the liquidator of Bryve Resources Pty Ltd (Bryve Resources).

The orders made were in respect of the following payments to be made by Qube and/or Mr Stanton, as well as standard costs of the proceeding, to Bryve Resources:

- payments previously advanced by the Company to Qube, under the directions of Mr Stanton (to be paid either by Qube or Mr Stanton); and

- payments previously made by the Company, either directly to Mr Stanton, or relevant third parties, for the benefit of Mr Stanton.

Relevant parties

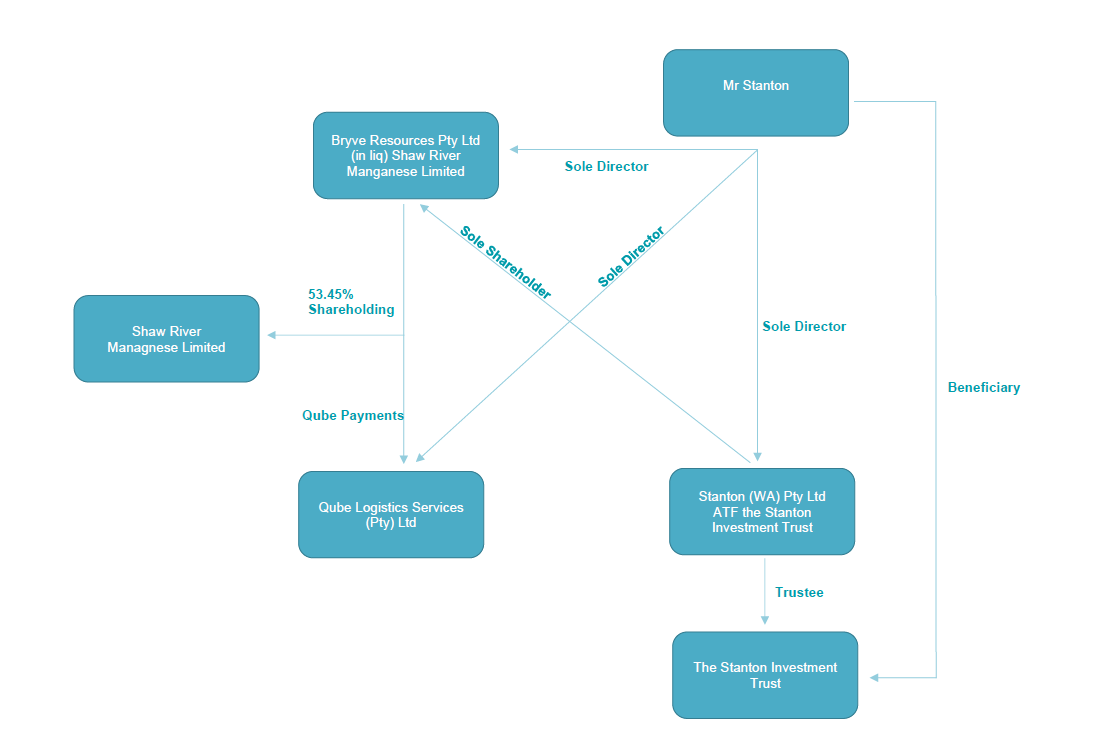

The relevant parties to the proceeding and their relationship can be summarised as follows:

Background

Bryve Resources was incorporated in August 2014 for the purpose of investing in Shaw River for its Otjozondu Project, involving manganese exploration, production and development at its open cut mine in Namibia. Qube was incorporated in September 2014 in Namibia for the purpose of operating a logistics business transporting ore for the Otjozondu Project.

Things went south for Shaw River and Bryve Resources at the beginning of 2016 – Shaw River went into voluntary administration in January 2016 followed by Bryve Resources in March 2017. The liquidator of Bryve Resources subsequently discovered that:

- Bryve Resources failed to keep the books and records as required by section 286 of the Corporations Act 2001 (Cth) during the whole of the period after its incorporation, which was accepted by the court;

- Bryve Resources made various payments totalling AU$1,547,158.392 to Qube as a loan between 2014 to 2016 without written loan agreements, security, or express terms regarding interest payment or repayment dates (the Qube Payments); and

- Bryve Resources made various payments to third parties associated with Mr Stanton, including but not limited to Stanton WA, Mr Stanton directly, and credit card in Mr Stanton’s name.

In March 2020, the liquidator applied to the NSWSC seeking to recover the above payments.

Decisions

The court ultimately found that:

- In relation to the Qube payments:

- as there is no express term requiring repayments on a specified date by Qube, the loan or loans made to Qube were repayable on demand;

- evidence suggests that Qube was not in a position to raise sufficient funds to repay the loan;

- Bryve Resources itself was in a precarious financial position at the time the advances to Qube were made;

- Mr Stanton, acting as the sole director of Bryve Resources, breached his director’s duties under sections 180 and 181 of the Corporations Act 2001 (Cth), by allowing the company to make the advances knowing the company’s and/or Qube’s financial positions, was not acting with care and diligence, and did not act in the best interests of the company and its creditors.

- In relation to the Stanton payments:

- save for payments directly made to Mr Stanton, the remaining payments were made for the benefit of Mr Stanton within the meaning of section 588FDA(I)(b)(iii) of the Corporations Act, being in order to discharge or reduce some liability or obligation that Mr Stanton owed to the relevant third party or because the payment to that third party was otherwise financially advantageous to Mr Stanton;

- despite Mr Stanton being a substantial creditor of Bryve Resources, the company was making no repayments to its other significant creditor (Stanton WA) when it was making the Qube and Stanton payments;

- therefore, Bryve Resources left its other significant creditor ‘hanging out to dry’ when making the Qube and Stanton payments; and

- payments by Bryve Resources constituted unreasonable director-related transactions within the meaning of section 588FDA of the Corporations Act and are voidable and recoverable from Mr Stanton.

Key takeaway

- Corporate governance is important. This judgment is a reminder for companies to maintain adequate books and records, and for directors to exercise due care and diligence when discharging their duties under the Corporations Act 2001 (Cth).

- Unreasonable director-related transactions for the benefit of a director are recoverable by the liquidator despite the payments being made when the company was solvent, or even though the director is a creditor of the company.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Daniel Maroske, Director

Violet Li, Solicitor