Gazing into the crystal ball – when assessing whether a company is insolvent, how far into the future should the Court look?

In Anchorage Capital Master Offshore Ltd v Sparkes (No 3); Bank of Communications Co Ltd v Sparkes (No 2),[1] the NSW Supreme Court handed down judgment in two proceedings (which were heard together) arising from the failure of Arrium and its broader corporate group.[2] Of particular interest to insolvency practitioners, the Court was asked to consider whether Arrium was insolvent at a specific date on the basis that it was allegedly unable to repay a significant debt due some 18 months later.

Background

It is no understatement to say that the facts giving rise to this litigation are complex. In summary:

- Arrium Limited and its broader corporate group (Arrium) carried on three main businesses: mining, mining consumables and steel.

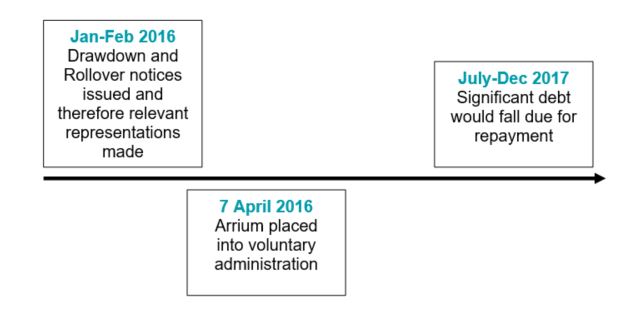

- Arrium had amassed a significant amount of debt due to its lenders which was due to mature in July to December 2017.

- Prior to this date, Arrium undertook a strategic review and obtained advice from financial and legal advisors to consider its options to repay or otherwise manage the debt.

- Whilst the strategic review was underway, in January and February 2016 Arrium issued several drawdown and rollover notices under various finance agreements with its lenders which enabled Arrium to (a) receive additional funds and (b) rollover previously advanced funding from those lenders. In accordance with the terms of those finance agreements, Arrium repeated various representations on the date of the drawdown and rollover notices. Critically, the representations made were to the effect that Arrium was solvent at the date of the relevant agreement and on each drawdown date it would be able to pay its debts as and when they became due and payable.[3]

- Shortly after the representations were made, in April 2016 Arrium was placed into voluntary administration.

The current proceedings

The Plaintiffs comprised various financiers of Arrium[4] (the Lenders) who commenced proceedings for various claims against Arrium,[5] which included a claim that:

- By signing the drawdown and rollover notices, those company officers of Arrium had breached a duty of care owed to the Lenders because the representations were false, causing loss to those Lenders; and

- (On a similar factual basis to the above) that Arrium had engaged in misleading and deceptive conduct, causing loss to those Lenders.

How had the alleged breach occurred? The Lenders argued that Arrium had breached its representations that it was solvent because, by no later than 7 February 2016, Arrium had no ability to repay the significant debt which was due to mature in July 2017.

Insolvency practitioners will no doubt observe that whether Arrium had breached its representations turned on whether Arrium was insolvent at the time the representations were made, that is, the date of the drawdown and rollover notices. In determining this question, the Court considered whether it should have regard to future events in assessing whether a company is insolvent.

Insolvency – general principles

Section 95A of the Corporations Act 2001 (Cth) provides that a person is solvent if, and only if, the person was able to pay all of their debts as and when they become due and payable and that a person who is not solvent is insolvent.

The general principles on which the Lenders relied were:

- Solvency is a question of fact proved on the balance of probabilities which involves a realistic commercial assessment of the company’s financial position as a whole.[6]

- Unless there is evidence to the contrary, ordinarily a debt is taken to be owing at the time stipulated for payment in the contract.[7]

- Whether a company is solvent involves a ‘future looking’ analysis. ‘[T]he question is not simply whether the company can pay debts falling due at or around the date the question arises but whether, as at that date, it can pay debts falling due in the future.’ How far into the future the Court may look is determined having regard to the facts of the particular case. However, Courts should avoid what would amount to speculation.[8]

- Solvency is determined by the facts known, or ought to be known, as at the relevant date. It is not an exercise with the benefit of hindsight. That being said, the Court may have regard to what in fact occurred if it would ‘shed light’ on what was likely to come to pass.[9]

The Lenders’ critical contentions regarding solvency

Whilst the general principles outlined above on which the Lenders relied were uncontroversial, two contentions which the Lenders sought to derive from them were controversial:

- In applying the civil standard of proof to the question of solvency, Arrium was insolvent as at January 2016 if it was more likely than not that Arrium would not be able to pay the significant debt falling due in July 2017, when it did fall due. This argument would only be successful if the future event (being that Arrium could not pay the significant debt in July 2017),[10] came to pass but the assessment of whether this would occur was considered as at January 2016 (the Standard of Proof Question); and

- A mere theoretical possibility that the Lenders would compromise debts which Arrium owed to the Lenders was not sufficient to preclude a finding of insolvency in circumstances where, without that compromise, Arrium would be unable to pay the debt as and when it fell due, and that, accordingly, the party contending that the assessment of solvency should be undertaken on the basis of that compromise, bore the onus of proving that proposition (the Onus Question).

The Court’s Decision

The Lenders’ claims were dismissed. As a general proposition, the Court was careful to distinguish between whether Arrium was in fact insolvent (being the relevant question) as opposed to whether Arrium was likely to become insolvent.

The Standard of Proof Question

The Honourable Justice Ball considered that the Lenders’ argument confused (a) the standard of proof required in order to prove insolvency as at January 2016 with (b) the certainty that a future situation would come to pass that was required in order to meet that standard of proof. As his Honour succinctly put it, the question “is one of fact, not likelihood”.[11]

Rather, whether Arrium was insolvent as at January 2016 had to be proved on the balance of probabilities. This required the Court to predict what would happen 18 months later in July 2017, based on what was known in January 2016. His Honour stated that “At the most all that could be said is that it was unlikely that Arrium would be able to pay debts falling due in July 2017. But that is equivalent to saying that Arrium was likely to become insolvent, not that it was insolvent, from 7 January 2016 on”.[12]

The Onus Question

Justice Ball disagreed that the established principles applied as proposed by the Lenders. Those principles generally relate to a trade creditor, not in the context of a lender as was the case here. His Honour adopted the position that it was for the Lenders to prove that, from 7 January 2016, it was unlikely the relevant Lenders would be prepared to extend their loans. This was part of the Lenders’ onus of proving that Arrium was insolvent as at January 2016.

Taking note of the fact that Arrium was a publicly listed company which relied upon lending for (part of) its working capital, his Honour considered that:

- In the ordinary course, Arrium would have ‘rolled over’ or replaced the lending as the facilities became due for repayment; and

- At the time of the drawdowns, Arrium had approximately $2.3 million in net assets with approximately 16 months to find a way to ‘roll over’ or replace the significant debt which was maturing in July 2017.

Sale of the Mining Consumables Business

The Lenders argued that the ‘only way’ by which Arrium could repay the significant debt by July 2017 was by selling its vital mining consumables business (described as the jewel in Arrium’s crown) and that it was ‘apparent’, as early as 7 January 2016, that the sale of this key business would not be for an amount sufficient to enable it to repay debt as well as continue as a viable business. This is against the background of Arrium being placed into voluntary administration only six weeks after the last drawdown was made (and consequently also the date the relevant representations as to solvency were given).

With respect to the sale of the mining consumables business, his Honour stated that the relevant question was whether Arrium was able to obtain an acceptable price for that business before July 2017. Particularly, it was no answer to say that it was ‘apparent’, as at January 2016, that Arrium would not obtain the requisite sale price. It was not possible to state this as a certain conclusion at that time.

Run out of cash

The Lenders also sought to argue that Arrium would run out of cash by about July 2016.[13] The Court was presented with a wide array of business plans, budgets and forecasts which showed possible outcomes. Importantly, the liquidity forecasts (which were identified by the Liquidator as the business records best able to show Arrium’s short-term cash flow position) did not show that Arrium would run out of funds in or before July 2017. The evidence did not demonstrate that there was no real prospect that Arrium could repay the debt in July 2017 (for example, by sale of the mining consumables business), but rather, that there was simply a risk that this might come to pass.

Voluntary administration

Justice Ball considered that the mere fact that Arrium did go into voluntary administration on 7 April 2016 was not evidence that Arrium was in fact insolvent as at that date (nor in January/February 2016 as at the date of the drawdowns). Rather, this was simply evidence of the directors’ opinion that Arrium was, or was likely to be, insolvent. To conclude otherwise would be an impermissible use of hindsight.

Ultimately, Justice Ball considered that it was simply too uncertain to definitively state that, in January/February 2016, it was more likely than not that Arrium would not be able to repay the significant debt some 18 months later in July 2017.

Key Takeaway

- Whether an entity was insolvent as at a particular date is to be proved on the balance of probabilities. The assessment is one of fact, not likelihood.

- Whilst the test of insolvency is ‘future looking’, when considering future events, the Court will consider what would happen in the future, based on what was known, or knowable, at the particular date in question.

- To look too far into the future will be ‘too uncertain’ and amount to mere speculation at best or an impermissible use of hindsight. Notwithstanding this, the Court may have regard to what in fact occurred if it would ‘shed light’ on what was likely to come to pass.

If you found this insight article useful and you would like to subscribe to Gadens’ updates, click here.

Authored by:

Scott Couper, Partner

Tahlia O’Connor, Senior Associate

[1] [2021] NSWSC 1025 (Anchorage).

[2] A third proceeding for insolvent trading brought by the Liquidators of Arrium against its directors settled in principle during the hearing.

[3] In summary, the representations were (a) that there had been no change which had a material adverse effect on Arrium’s financial position, (b) that no event of default or potential event of default had occurred or continued unremedied; and/or (c) that Arrium was solvent. See [42]-[45] and [244] of the decision.

[4] The lenders included parties who had directly financed Arrium but also assignees who had taken an assignment of debt from those lenders.

[5] The ‘Anchorage Proceeding’ was brought by lenders against various company officers of Arrium seeking to recover loss for breach of duty of care and misleading and deceptive conduct arising out of the representations as to solvency made by virtue of the drawdown and rollover notices (discussed further below), which were false at the time those representations were made. The ‘BOC Proceeding’ was brought by other lenders against various company officers of Arrium seeking to recover loss, also based on misleading and deceptive conduct arising out of the representations as to solvency made by virtue of the drawdown and rollover notices.

[6] Anchorage at [255] and [257] and cases cited therein.

[7] Anchorage at [258] and cases cited therein.

[8] Anchorage at [259]-[260] and cases cited therein.

[9] Anchorage at [262] and cases cited therein.

[10] A number of options were on the table including refinance, recapitalisation, sale of assets etc. In particular, this included the sale of Arrium’s vital mining consumables business (described as the jewel in Arrium’s crown). As an aside, the voluntary administrators ultimately did sell Arrium’s mining consumables business in late 2016.

[11] Anchorage at [265].

[12] Anchorage at [266].

[13] Note that his Honour ultimately considered that the relevant Lender Plaintiffs should not be permitted to advance this argument (brought late in the proceedings)