Gunns ahoy: Federal Court reignites debate over the application of the peak indebtedness rule and set-off defence in unfair preference claims

In the recent Gunns decisions, the Federal Court considered three separate unfair preference claims brought by the liquidators of Gunns Limited (in Liquidation) (Gunns) against:

- Badenoch Integrated Logging Pty Ltd (Badenoch);[1]

- Bluewood Industries Pty Ltd (Bluewood);[2] and

- Edenborn Pty Ltd (Edenborn).[3]

Badenoch, Bluewood and Edenborn each received significant sums from Gunns during the relation-back period and evidence available to Gunns’ liquidators indicated that other unsecured creditors were unlikely to receive a dividend payment in the winding up.

The proceedings

Gunns’ liquidators commenced proceedings seeking to recover the payments received by Badenoch, Bluewood and Edenborn during the relation-back period, pursuant to section 588FA of the Corporations Act 2001 (Cth) (the Corps Act). Because the payments were ostensibly “unfair preference payments” within the meaning of section 588FA(1), each case generally focused on the availability of defences.

Relevantly, the Federal Court considered the availability of the running account defence and the set-off defence under sections 588FA(3) and 553C of the Corps Act.

Running account defence and the peak indebtedness rule

The running account defence provides that where a company made payments to a creditor that were an integral part of a continuing business relationship (e.g. a running account), and in the course of the relationship the level of the company’s net indebtedness increased and reduced from time to time as the result of a series of transactions forming part of the relationship, all transactions forming part of the relationship shall constitute a single transaction. That “single transaction” will then be the basis for a liquidator’s unfair preference claim.

In the Gunns cases, Badenoch, Bluewood and Edenborn all had continuing business relationships and running accounts with Gunns. The issue in contention was therefore how the “single transaction” ought to be quantified. In particular, whether or not it ought to be quantified based upon the “peak indebtedness rule”.

The peak indebtedness rule relates back to the High Court’s decision in Rees,[4] in which Chief Justice Barwick remarked:

“In my opinion the liquidator can choose any point during the statutory period [i.e. the 6 month relation-back period] in his endeavour to show that from that point on there was a preferential payment and I see no reason why he should not choose, as he did here, the point of peak indebtedness of the account during the six months period.”

Accordingly, the rule allows a liquidator to calculate the amount of an unfair preference claim by subtracting the debt due at the conclusion of the continuing business relationship from the debt due at the point of peak indebtedness (i.e. the highest point of indebtedness, rather than the debt due as at day 1 of the relation-back period).

Whilst the peak indebtedness rule has been applied by various Australian courts in the application of section 588FA of the Corps Act, it was called into question in 2015 when the New Zealand Court of Appeal (NZCA) delivered its decision in Timberworld.[5] In that case, the NZCA chose not to apply the peak indebtedness rule to an analogous provision in the Companies Act 1993 (NZ) because, in its view, the assessment of the transactions should commence when the relation-back period commences:

“… the starting point is the first transaction during the running account falling within the specified period. It follows from this position that to arrive at some artificial point during the course of all the relevant transactions and to select the date of peak indebtedness (resulting in the transactions prior to this point being disregarded), would be to ignore the express wording used by Parliament.”

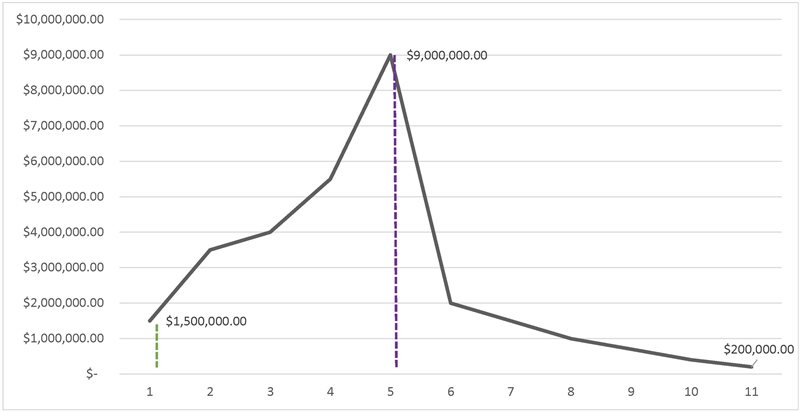

The Australian and New Zealand positions are compared below:

AUS – purple – peak indebtedness rule = $8.8M

NZ – green – start to end = $1.3M

In Gunns, the Federal Court considered the reasons given by the NZCA in Timberworld, but was not persuaded that the peak indebtedness rule no longer applies under Australian law. It maintained that the peak indebtedness rule is reconcilable with section 588FA(3) of the Corps Act, together with the ultimate effect doctrine which section 588FA(3) was designed to embody. Accordingly, the Federal Court held that the liquidator could nominate the point of Gunns’ peak indebtedness within the relation-back period as the starting point for the purposes of calculating the “single transaction”.

Set-off defence

The set-off defence under section 553C of the Corps Act provides that where there have been mutual dealings between an insolvent company and a creditor wanting to claim against the insolvent company:

- the sum due from the one party (e.g. from the insolvent company to the creditor) shall be set-off against any sum due from the other party (e.g. from the creditor to the insolvent company); and

- the balance of the account will be admissible to proof against the company, or payable to the company, as the case may be.

However, a creditor cannot claim the benefit of a set-off if they had notice of the fact that the company was insolvent.

Historically, and in other common law jurisdictions such as the UK, the set-off defence has been held not to apply to unfair preference claims, as such claims are not considered company property. However, over the past couple of decades,[6] a number of decisions have been handed down by Australian courts indicating that the set-off defence is in fact available to creditors facing unfair preference claims in Australia. This has resulted in some uncertainty as to whether section 553C may be relied on as a defence to an unfair preference claim.

In the Gunns cases, Badenoch and Bluewood both argued that the set-off defence should apply to the liquidator’s unfair preference claim, as they were still owed debts by Gunns. They argued that their liability under section 588FA for the unfair preference should be set-off by the amount owing to them by Gunns. In considering their arguments, Justice Davies identified that there are various conflicting authorities regarding the application of the set-off defence to unfair preference claims, but ultimately was not required to decide upon the issue because, even if the set-off defence was available, it would not be available to Badenoch and Bluewood in circumstances where they had notice of facts sufficient to disclose that Gunns lacked the ability to pay its debts as and when they fell due. As a result, for now the uncertainty as to whether the set-off defence is available to a defendant of an unfair preference claim remains.

Key takeaways

- Peak indebtedness rule – Practitioners in Australia may now assume that liquidators are entitled to rely on the peak indebtedness rule when quantifying an unfair preference claim where there existed a running account.

- Set-off defence – Practitioners will unfortunately need to continue waiting for this issue to be clarified by a superior court or the legislature. However, most recent Australian cases indicate the defence is available against an unfair preference claim.[7]

Authored by:

Guy Edgecombe, Partner

Mitchell Byram, Associate

[1] Bryant, in the matter of Gunns Limited (in liq) (receivers and managers appointed) v Badenoch Integrated Logging Pty Ltd [2020] FCA 713.

[2] Bryant, in the matter of Gunns Limited (in liq) (receivers and managers appointed) v Bluewood Industries Pty Ltd [2020] FCA 714.

[3] Bryant, in the matter of Gunns Limited (in liq) (receivers and managers appointed) v Edenborn Pty Ltd [2020] FCA 715.

[4] Rees v Bank of New South Wales [1964] HCA 47.

[5] Timberworld v Levin [2015] 3 NZLR 365.

[6] Since Re Parker (1997) 80 FCR 1.

[7] For further information about these cases, see our article about this issue here.